Investment in Oman

In order to provide the supportive causes for achieving our future goals, we are determined to take the necessary measures to restructure the State’s administrative apparatus, modernize the system of legislation, laws, work programs and mechanisms, uphold its values and principles, adopt the latest methods, simplify procedures, promote governance of performance, integrity, and accountability to ensure full alignment and consistency with the requirements of our Vision and its goals.

While identifying the national priorities, the Vision focuses on reshaping the roles of and relation between the public, private and civil sectors to ensure effective economic management; achieve a developed, diversified and sustainable national economy; ensure fair distribution of development gains among governorates; and protect the nation’s natural resources and unique environment.

– HM SULTAN HAITHAM BIN TARIQ

23. February, 2020

Oman – Attractive Investment Destination

-

Rapid economic expansion in the Sultanate over the last 20 years

-

Government diversification initiatives and rising population driving critical infrastructure investment

-

Favorable regulatory model and developed PPP framework

|

|

Why Oman?

The Omani government has been committed to STIMULATING GROWTH in the country’s non-oil GDP through significant spending on infrastructure

This is expected to drive GREATER TOURISM and business activity and therefore to strengthen and diversify the economy, which in turn, will boost GDP and reduce the longterm dependency on oil

There is growing demand for SOCIAL AND ECONOMIC infrastructure and a rising population requiring a strong and dependable pipeline of investment opportunities in both established and emerging infrastructure asset classes

The Case for Investment in Oman

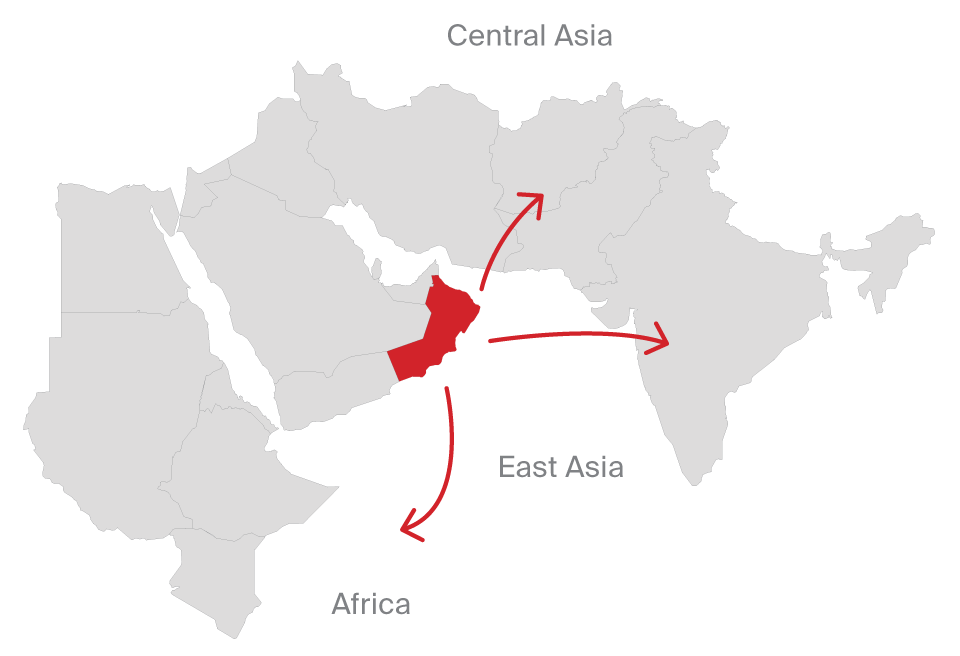

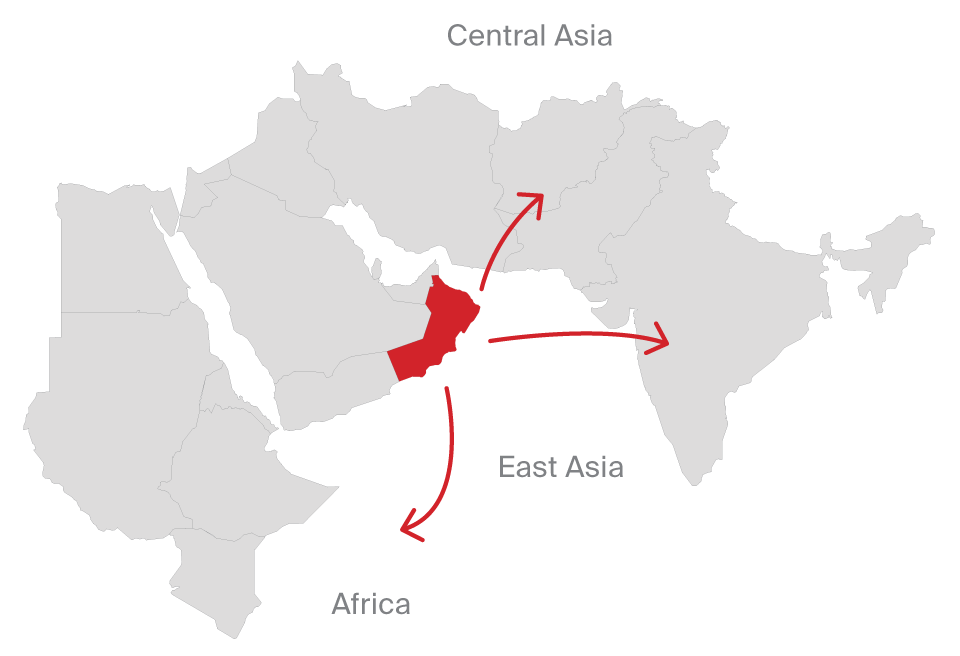

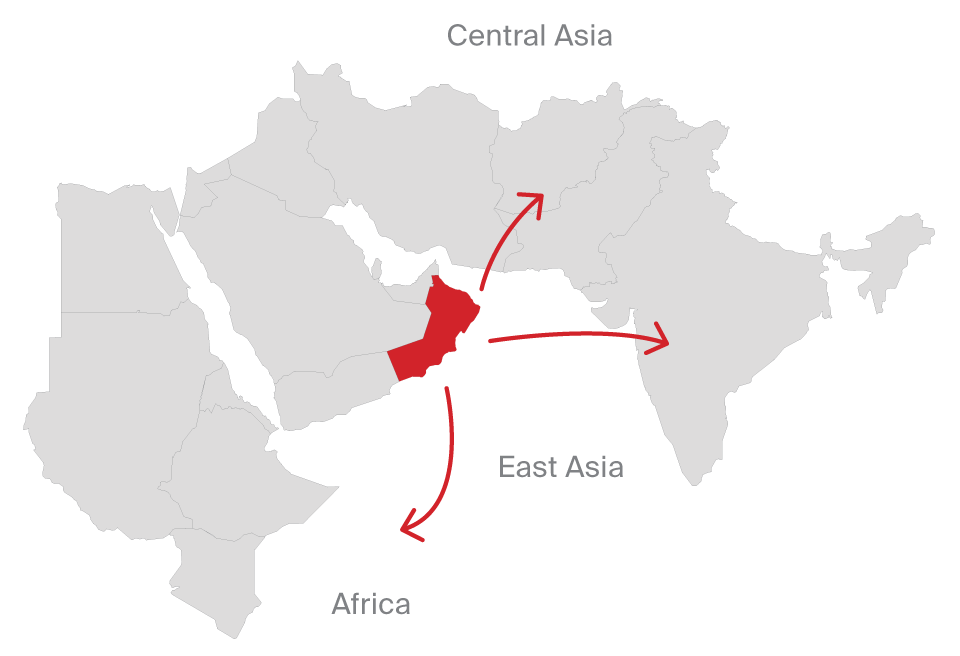

Oman Strategic Location

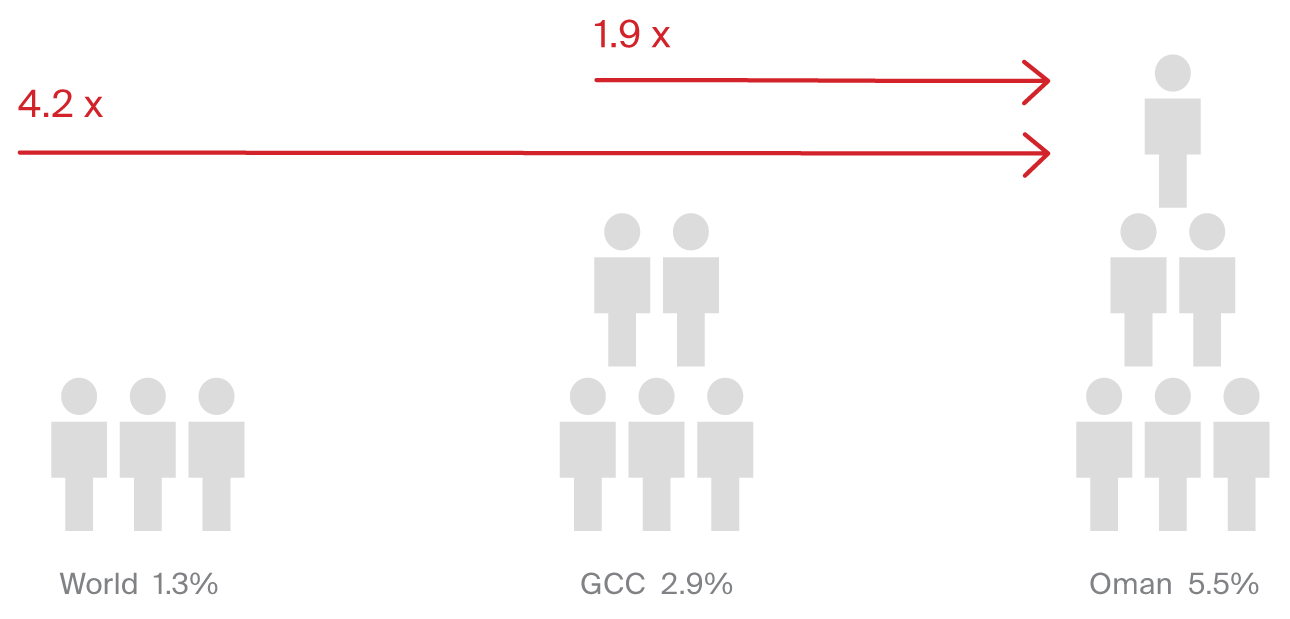

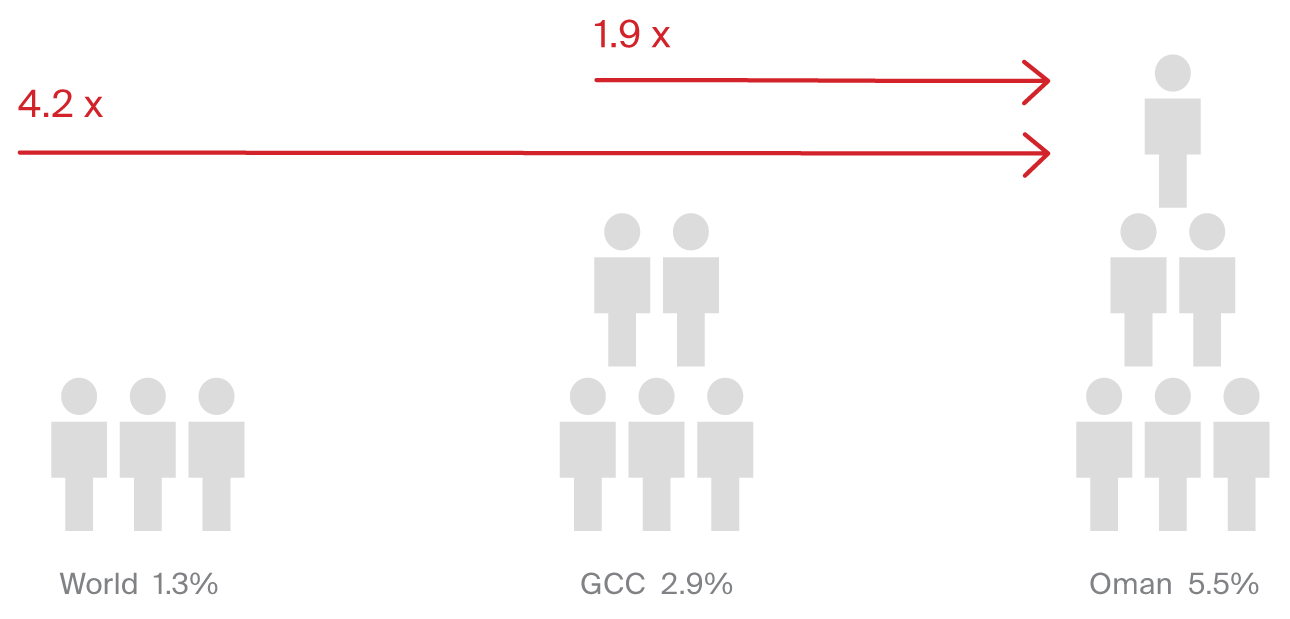

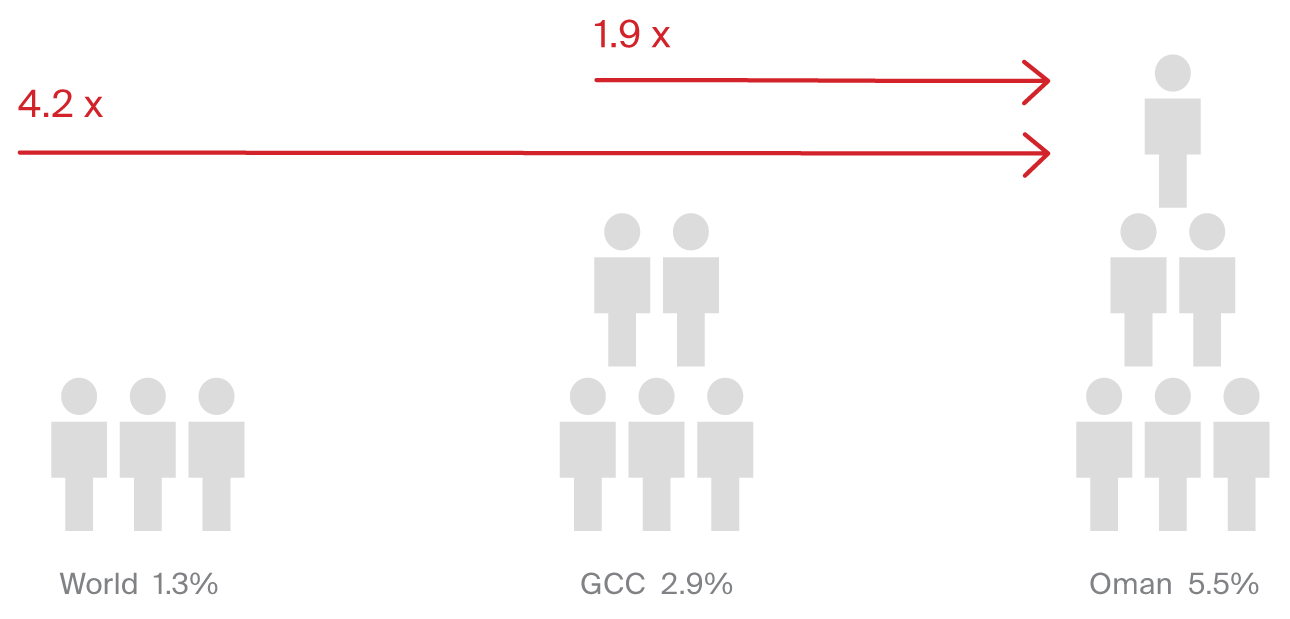

Population CAGR 2015-2020 in Oman

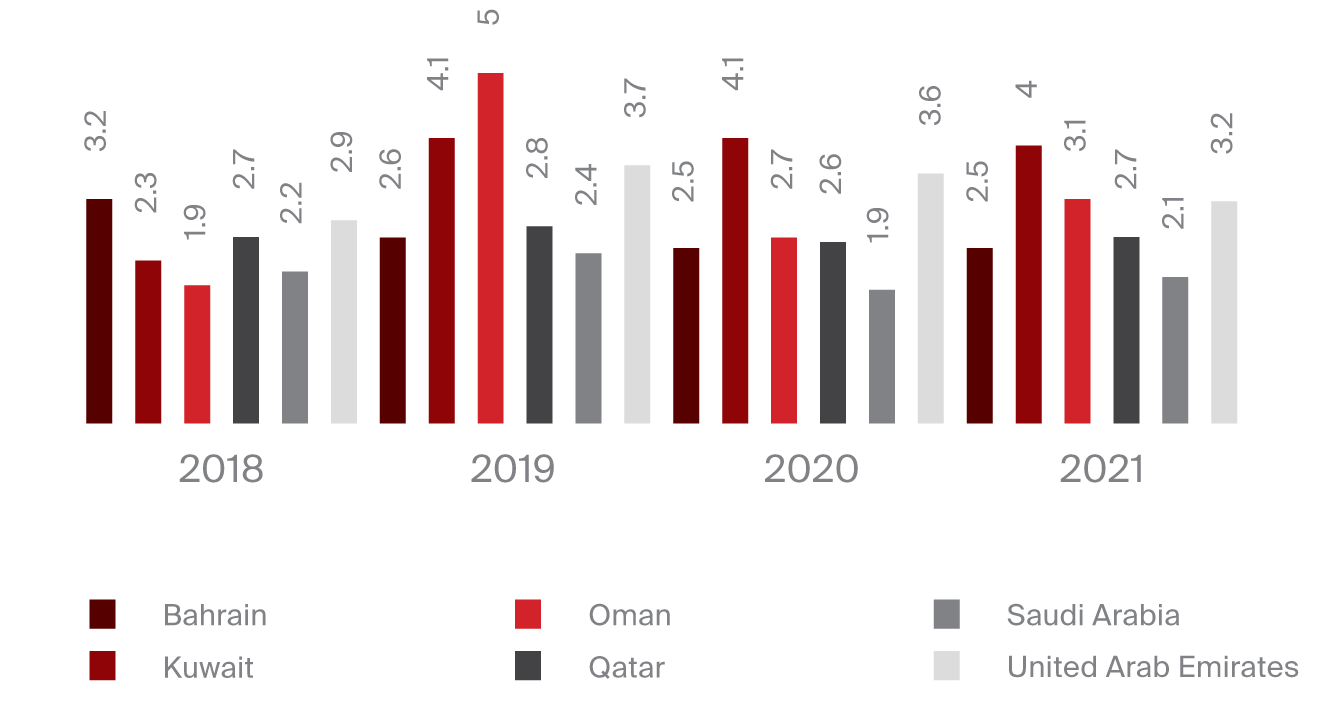

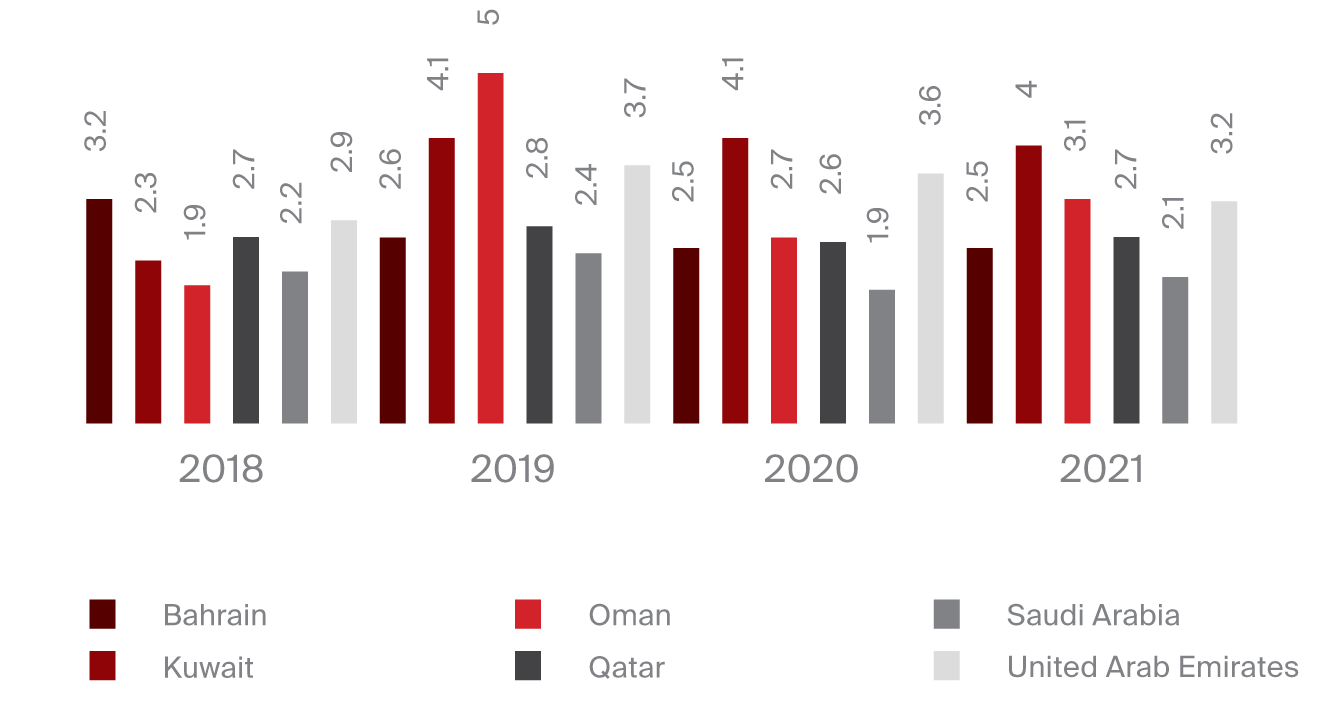

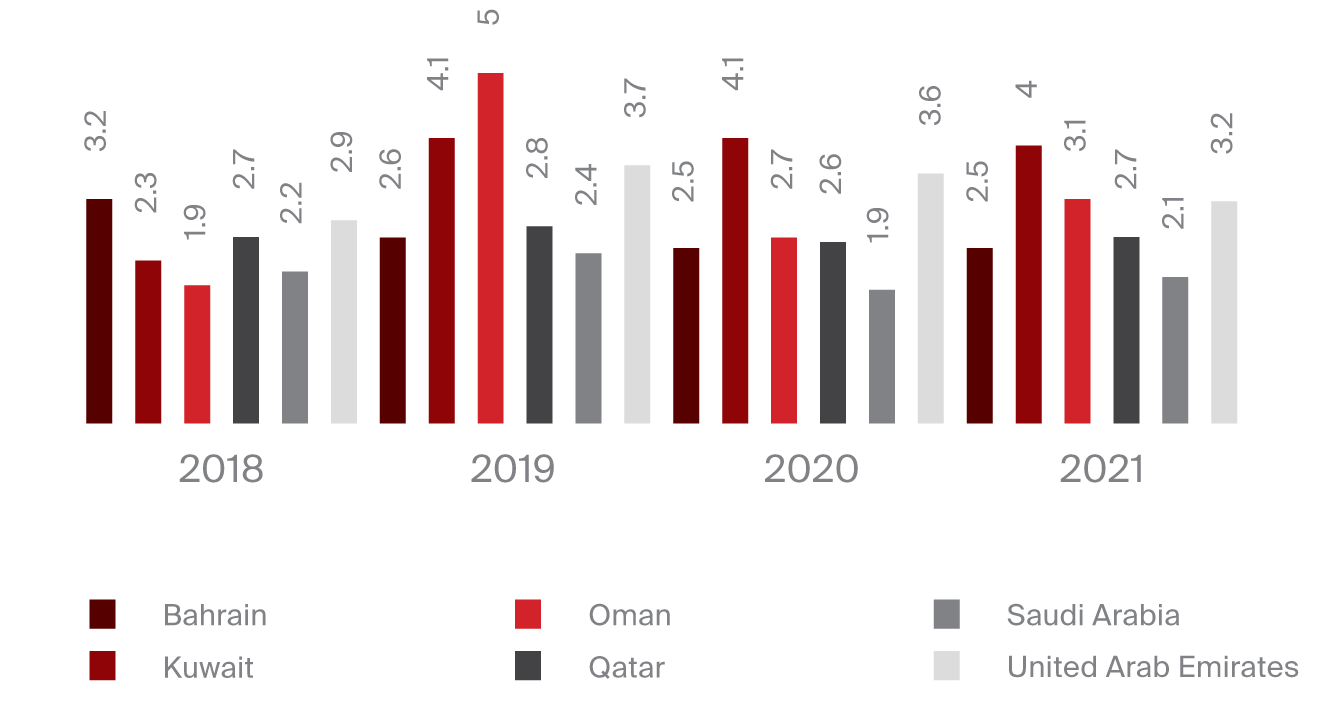

Real GDP Growth Rates in GCC for 2018F -19F

Key Growth Sectors Requiring Private Finance

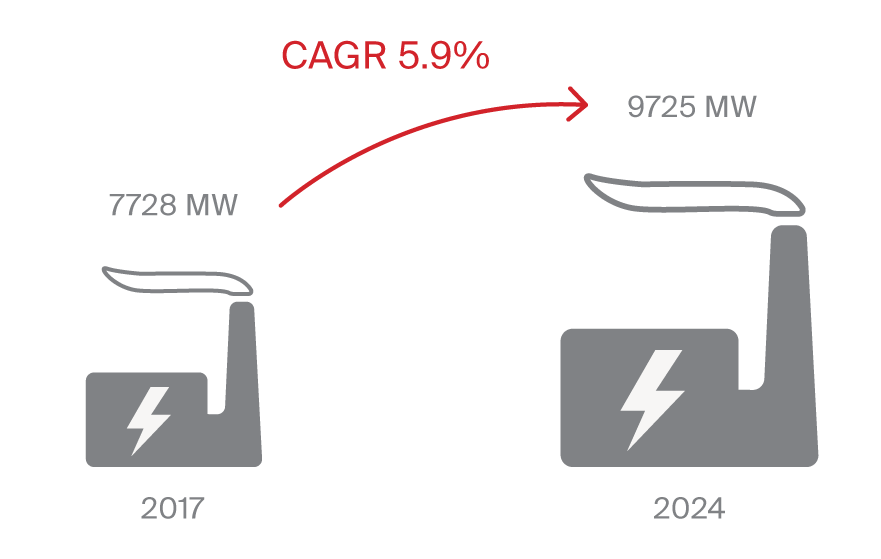

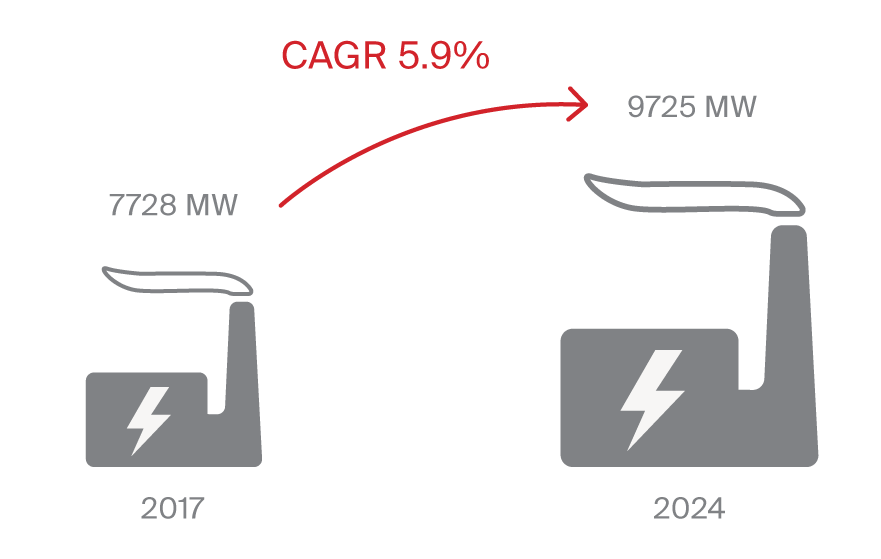

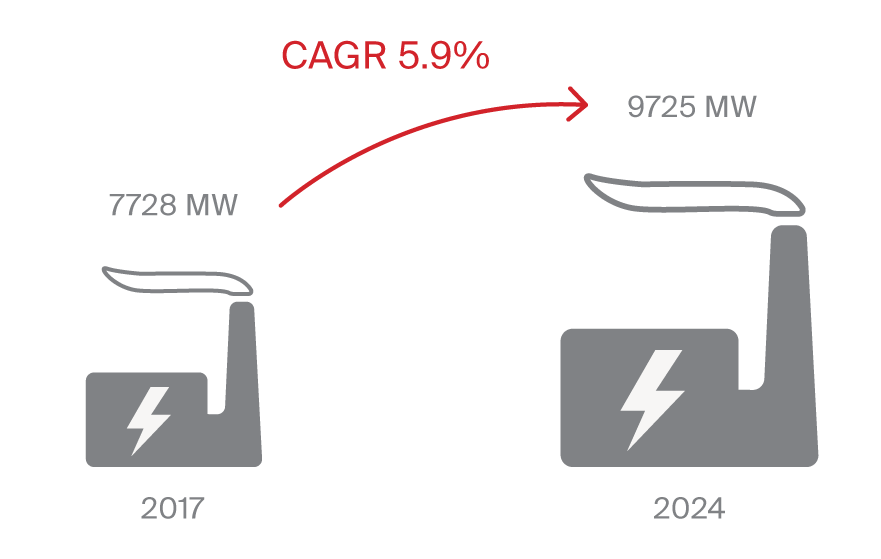

Projected Installed Capacity and Peak Demand (MW)

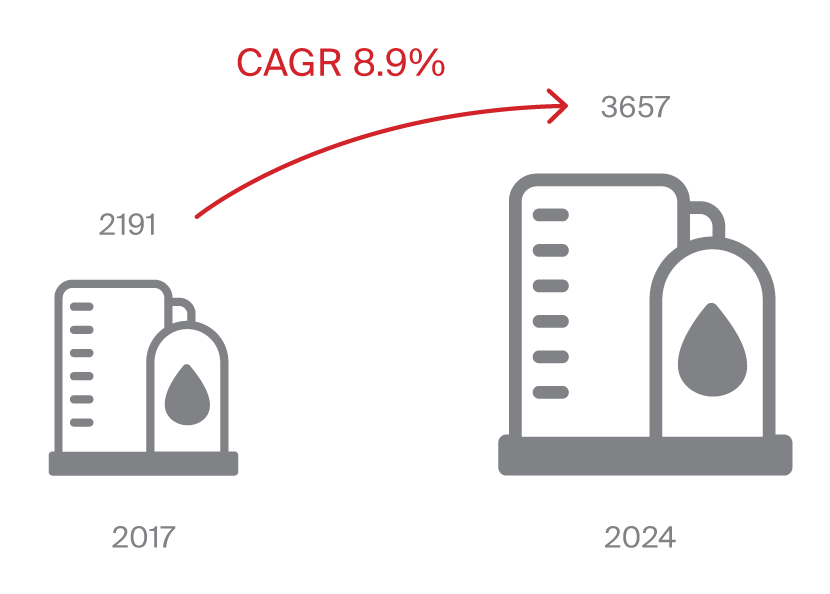

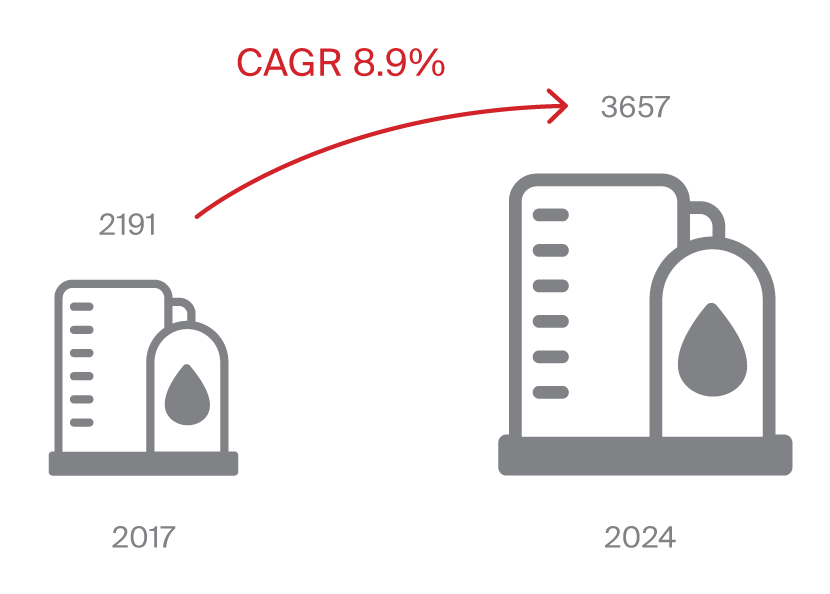

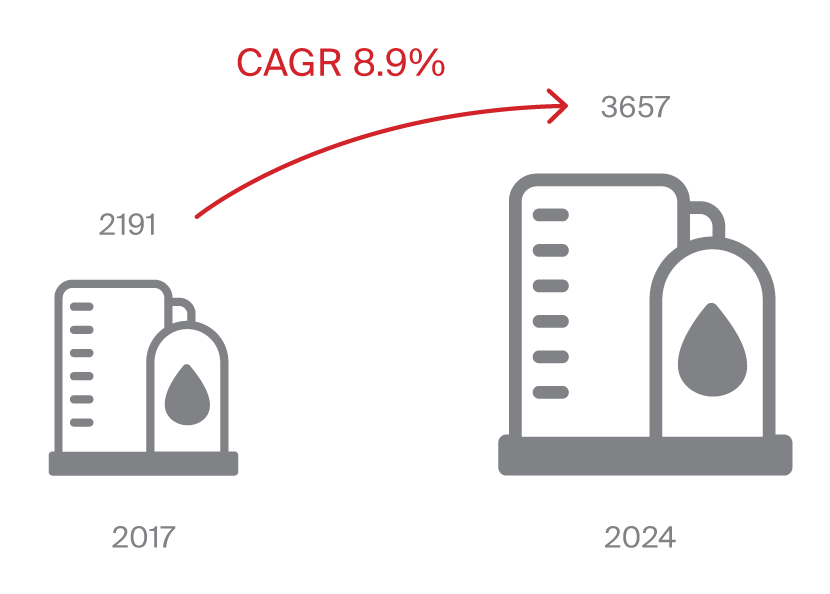

Projected Water Dammed M³

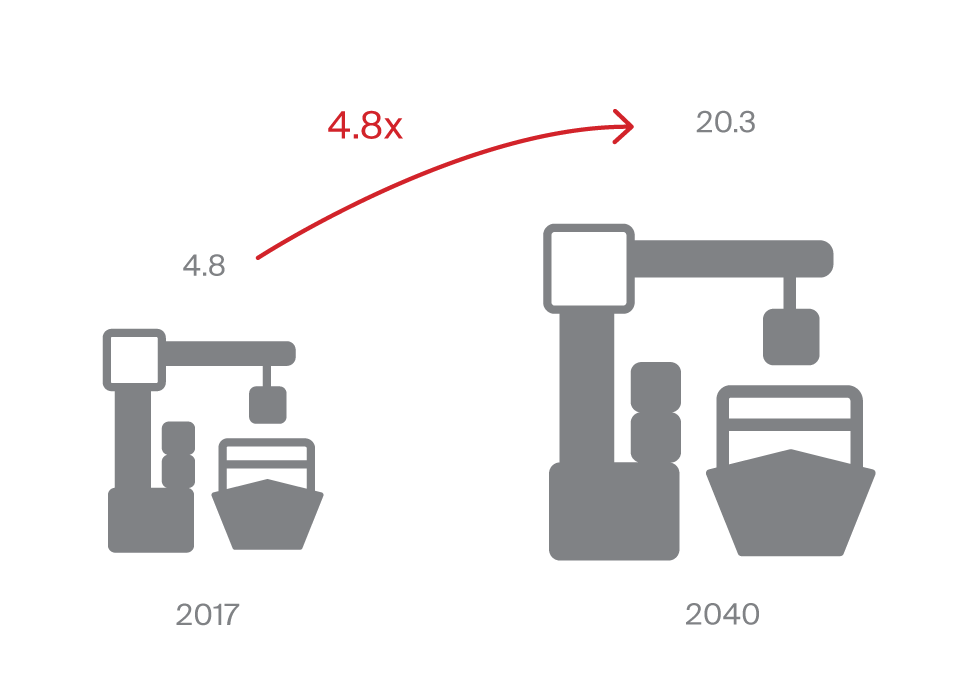

Oman Ports’ Capacity (in MN TEU)

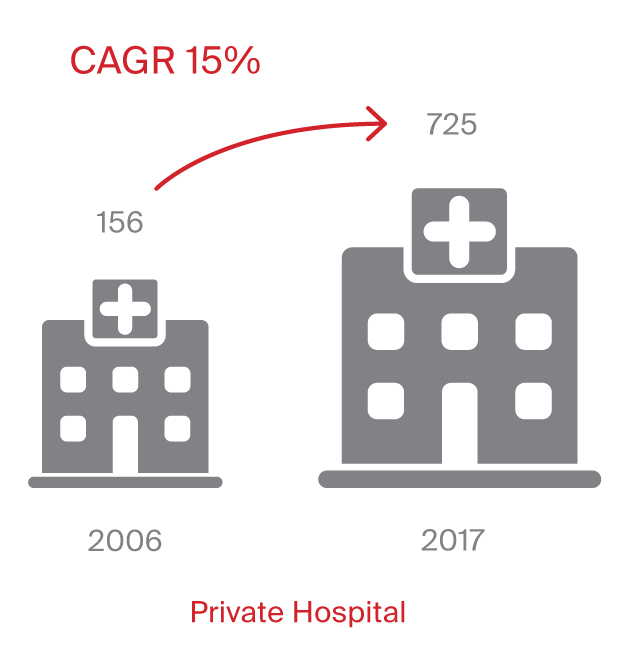

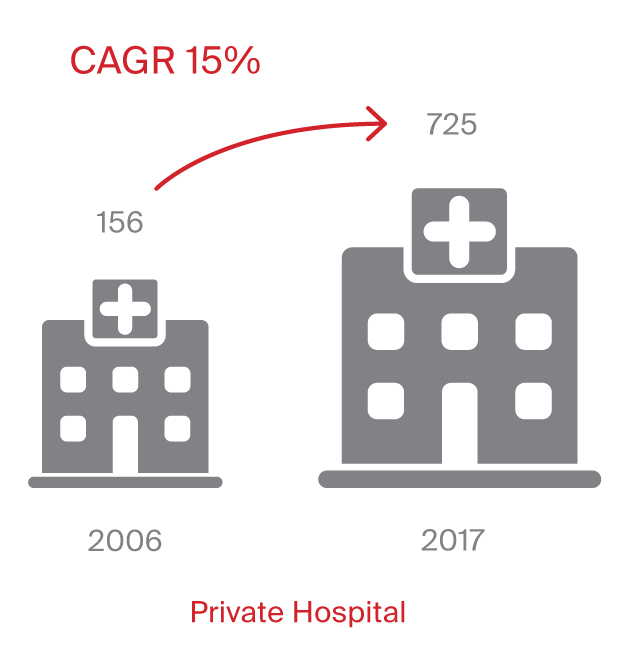

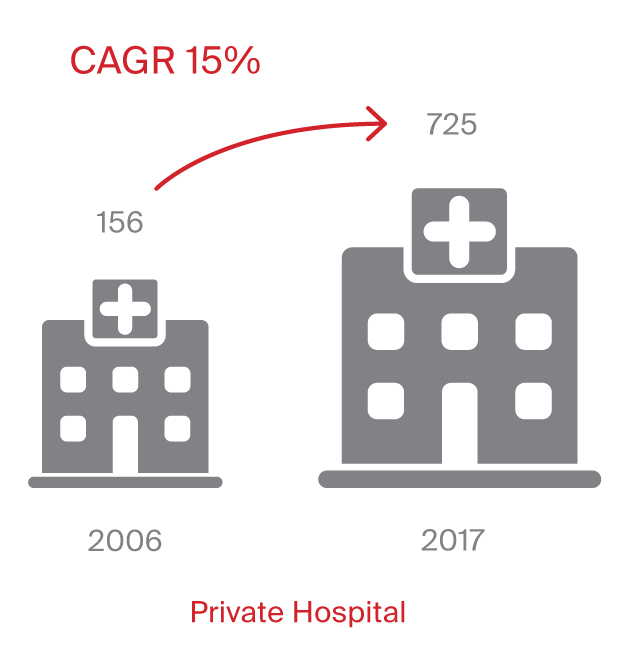

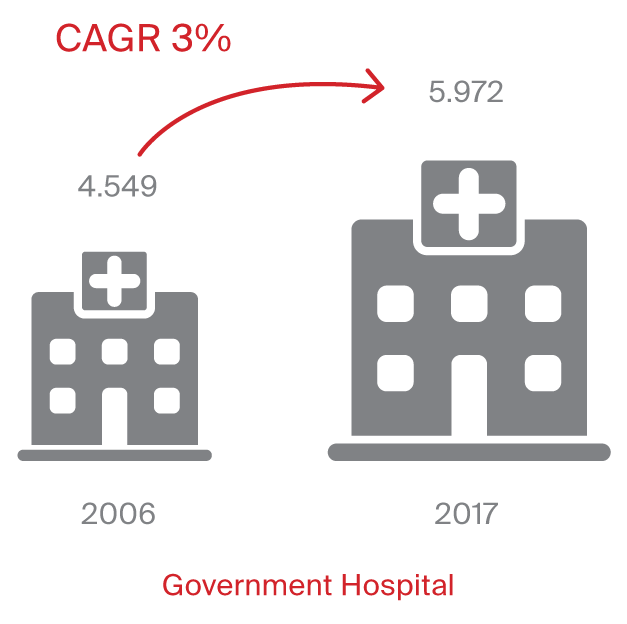

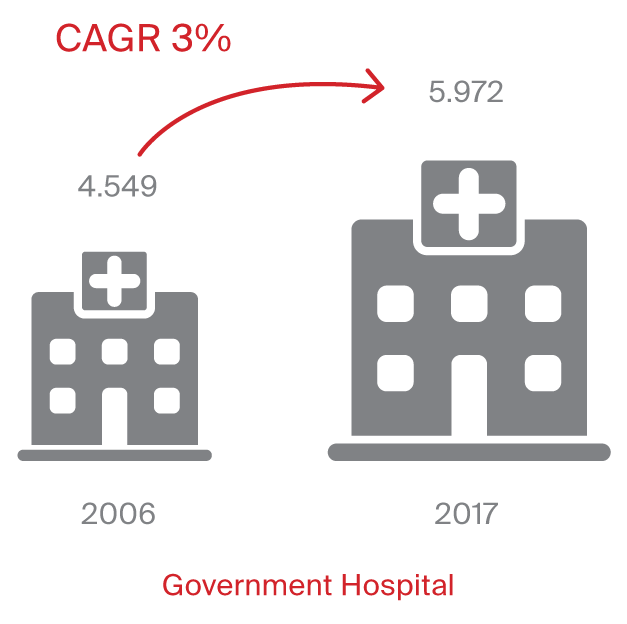

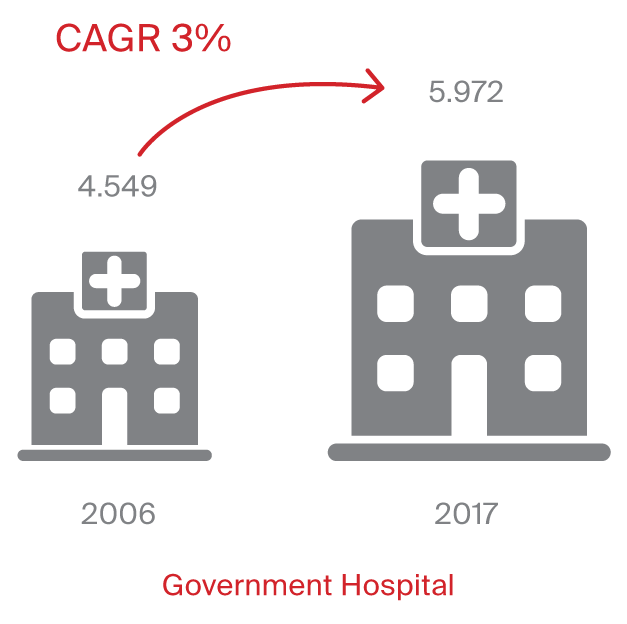

Number of Hospital Beds in Oman

1,500 additional beds required over 3 years